In contrast, a credit entry on the right side increases the account. On the other hand, for a liability account or a shareholders’ equity, a debit entry on the left side decreases the account.

read more, while a cash pay-out will credit the account.

The examples include Short-Term Investments, Prepaid Expenses, Supplies, Land, equipment, furniture & fixtures etc. It implies that a business that receives cash will debit the asset account The Asset Account Asset Accounts are one of the categories in the General Ledger Accounts holding all the credit & debit details of a Company’s assets.

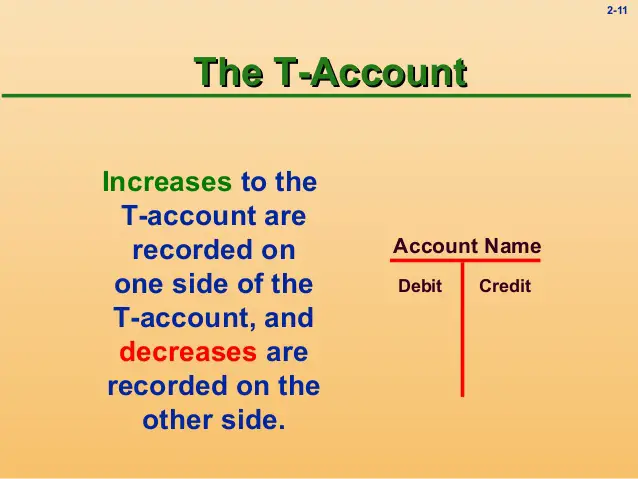

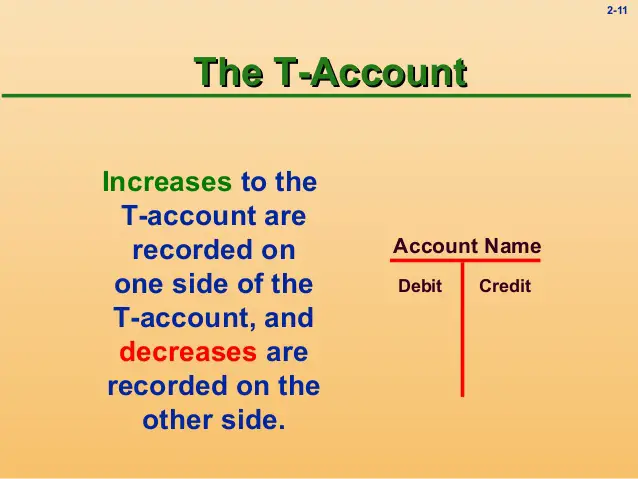

For an asset account, a debit entry on the left side increases to the account, while a credit entry on the right side results in a decrease to the account. For different account types, a debit and a credit may increase or decrease the account value. read more impact at least two of the company’s accounts in such a way that if one account gets a debit entry, then another account will get a credit entry of the identical amount to close each transaction that occurs. The goods involved have monetary and tangible economic value, which may be recorded and presented in the company's financial statements. In a T account, all business transactions Business Transactions A business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.). The below table presents the general journal entries for the two transactions mentioned in the T accounts above. read more is expected to be debited since it is a liability account. On the other hand, the Notes Payable account Notes Payable Account Notes Payable is a promissory note that records the borrower's written promise to the lender for paying up a certain amount, with interest, by a specified date. To reduce the Cash account, the account must be credited since it is an asset account. This transaction will decrease ABC’s Cash account by $5,000, and its liability Notes Payable account will also decrease by $5,000. read more with the following two transactions. It graphically represents credits on the right side and debits on the left. The T-account is named for the way bookkeeping entries are shown, which mimics the shape of the letter T. Let us take an example of T accounts Example Of T Accounts The T-Account is a visual representation of journal entries that are recorded in the general ledger account. #T account debit credit how to#

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked They serve as a key tool for monitoring and tracking the company's performance and ensuring the smooth operation of the firm.

It can be helpful in the avoidance of erroneous entries in the accounting system Accounting System Accounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. A T account is especially useful in the case of a compilation of challenging and complex accounting transactions where the accountant intends to track how the transaction impacts all other parts of the financial statements Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). read more impacts another account, which, in a way, helps simplify more complex transactions. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. read more as it displays how one side of an accounting transaction Accounting Transaction Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. Furthermore, the number of transactions entered as the debits must be equivalent to that of the credits. It is a useful facet of the double entry accounting method Double Entry Accounting Method Double Entry Accounting System is an accounting approach which states that each & every business transaction is recorded in at least 2 accounts, i.e., a Debit & a Credit. The shape supports the ease of accounting so that all additions and subtractions to the account can be tracked and represented easily.

The format of the T Account is given below –

The name of the account is written above the “T” along with the account number (if available), while the total balance for each “T” account is written at the bottom of the account.

Other Important Terms Related to T Account.

0 kommentar(er)

0 kommentar(er)